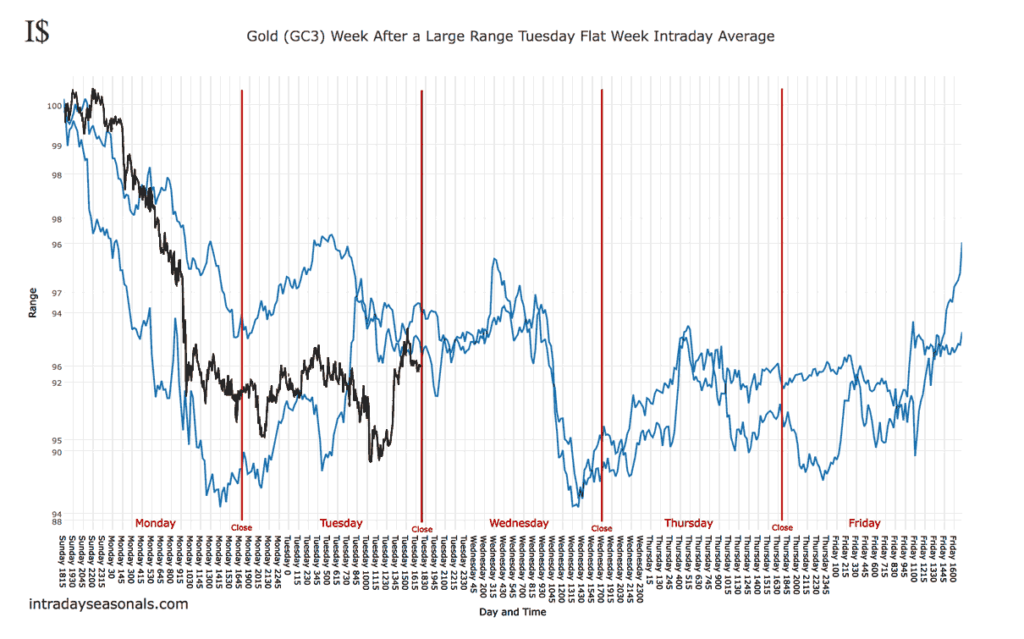

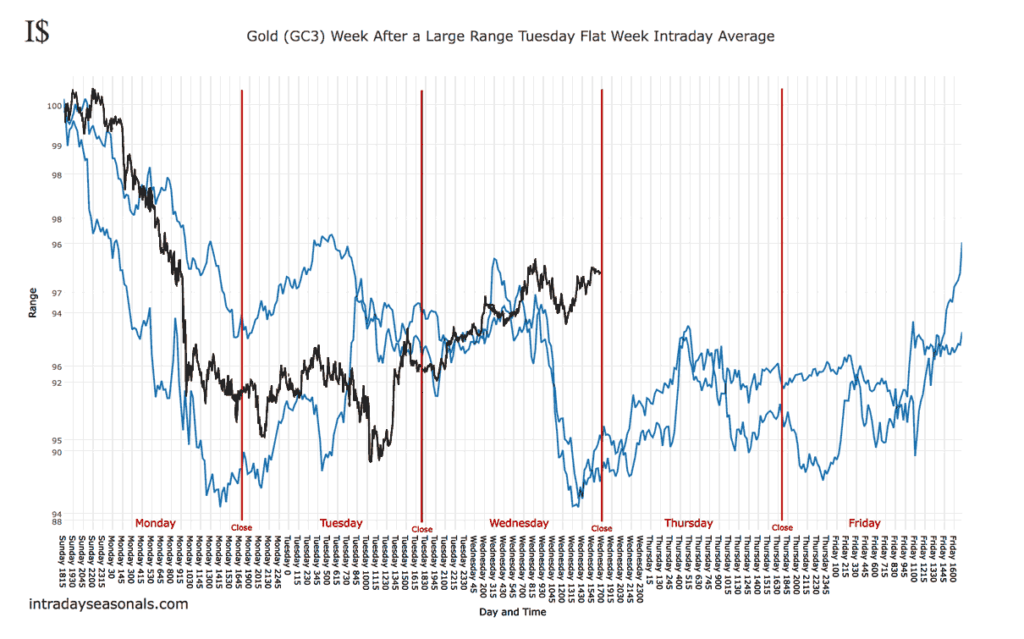

While having its only extended down move for the day when forecast, the move wasn’t nearly as pronounced, possibly indicating some more bullishness within the market. See below.

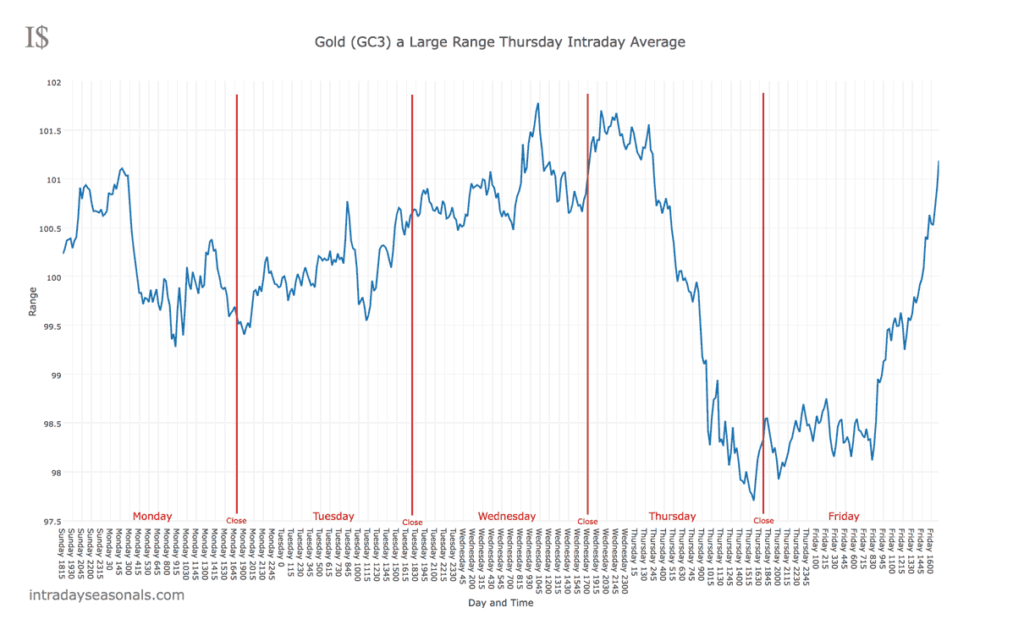

Thursday is already down to the bottom of the range of the late Wednesday move, which in contrast to the charts. It could be that Thursday will best match a flipped day of the two, hitting lows midway through and rebounding some towards close. The sharpest declining Thursday is typically seen when it’s the largest range of the week as well. For it to beat out Monday it would have to go below 1254.5. See-saw price action closing near the open seems more likely given the volatility already seen on Monday.